Bullish calls on gold increasing by the day

Weak jobs report further builds the case for gold

With the Gold Forum Americas just over a week away, the stars are aligning for gold.

The spot gold price returned to over US$2500 an ounce this week and close to its all-time high off the back of a weaker US dollar and lower yields.

It comes after a volatile week for US markets amid concerns of a recession, but all eyes today were on jobs data, which is likely to dictate the timing and size of a potential Federal Reserve interest rate cut.

It was announced that the US economy added 142,000 jobs in August, below consensus estimates of 164,000 jobs.

The number of jobs added in June and July was also revised down.

Spot gold spiked to US$2528/oz following the release, within US$3 of the all-time high set on August 20.

Increasingly bullish

On Monday, Goldman Sachs released a report which declared gold as its preferred near-term long commodity exposure.

The bank, a renowned copper bull, said the rally in the red metal was delayed and slashed its 2025 price target by nearly US$5000 per tonne to US$10,100/t.

Goldman said gold was its preferred hedge against geopolitical and financial risks, with added support from imminent Fed rate cuts and ongoing central bank buying in emerging markets.

“In this softer cyclical environment, gold stands out as the commodity where we have the highest confidence in near-term upside,” analysts said.

“More specifically, we maintain our bullish US$2700/oz target for early 2025 and we open a long gold trading recommendation.”

Interest growing

This week, on the aptly named Gold Coast in Australia, Bell Potter Securities analyst David Coates reiterated his preference for precious metals in the commodity space.

“I think gold's got a lot of momentum behind it,” he said during the Resources Rising Stars conference.

“There are numerous catalysts for gold in the next 12 to 18 months, and I think it's early days. And as gold goes, I think silver will follow – silver's kind of been lagging.”

Coates said large institutional investors had been looking for more gold and copper exposure so far this year.

“I think that the cash generation that the established gold producers have shown, particularly in the last quarter, has attracted more capital to those names.”

ETF buying keeps rising

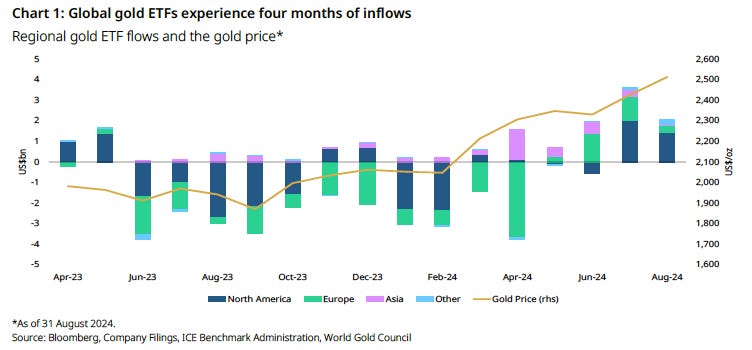

This week, the World Gold Council released its August report, which saw global gold ETF inflows rise for a fourth consecutive month.

Global physically backed gold ETFs added US$2.1 billion in August with all regions recording positive inflows, led by Western funds.

It narrowed gold ETF’s year-to-date losses to US$1 billion.

Global assets under management rose by 4.5% to US$257 billion and are up 20% since the start of the year.

Collective holdings increased by 29 tonnes to 3182t.