Comparing Gold Forum Americas from Peak to Peak

How does 2024 compare with the previous peak in 2011?

Members of the Denver Gold Group achieved a record nominal aggregate market capitalization of $486 billion during Gold Forum Americas 2011 when silver was priced at $40.46 per troy ounce (September 19, 2011) and gold’s afternoon London price fix was $1,794/oz. Platinum sold for a whopping $1,798/oz, while palladium set buyers back $721/oz (source - LBMA).

At that year’s Gold Forum (the very first at the Broadmoor Hotel), 23 silver miners were worth $66 billion, and 125 gold miners were valued at $420 billion, or $587 billion adjusted for inflation.

With less than a month to go until this year’s Gold Forum, there are 17 silver miners worth $18 billion and 121 gold miners worth $437 billion. Copper miners have risen to 11 and are worth $6.8 billion. With a sprinkling of other minerals, the Forum has a total market cap of $463 billion at today’s quotes.

Attendance was 1,068 in 2011, and DGG expects around 910 people on site this year. Overall, the composition of attendees remains stable, with member companies providing 49% of the total, the buy-side accounting for 29%, and other categories making up the balance. Notably, sell-side participation has shrunk dramatically from 14% in 2011 to just 6% this year, reflecting the broker-dealer sector's upheavals.

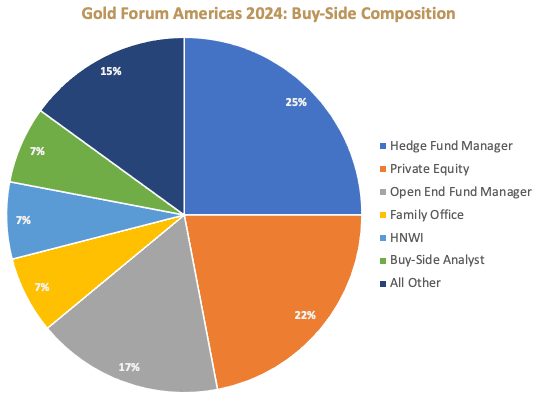

The buy-side composition has also shifted materially since 2011. That year, private equity had just one representative. This year, private equity makes up 22% of the total buy-side, almost matching hedge funds, which remain stable at one-quarter of the total. Open-end funds have fallen to 17% of the total buy-side, compared with 24% in 2011.

Correction: The first version of this article combined data from members participating in Gold Forum Europe and Gold Forum Americas. The corrected version only uses Gold Forum Americas 2024 data.