Copper, Silver, Platinum to be Added to US Critical Minerals List

Trump Administration aiming to ramp up domestic minerals production

The US Geological Survey has proposed the addition of six commodities to the US’ List of Critical Minerals.

The USGS released the draft list of 54 minerals on Monday, which proposed the inclusion of copper, silver, platinum, rhenium, potash, silicon and lead and the removal of arsenic and tellurium.

It marks the third update of the list, which was first devised in 2017 during US President Donald Trump’s first term.

Metallurgical coal and uranium have been referred for consideration by executive orders and will be analysed by the USGS for potential inclusion on the 2025 List of Critical Minerals.

“President Trump has made clear that strengthening America’s economic and national security means securing the resources that fuel our way of life,” Secretary of the Interior Doug Burgum said.

“This draft List of Critical Minerals provides a clear, science-based roadmap to reduce our dependence on foreign adversaries, expand domestic production and unleash American innovation.”

Acting USGS director Sarah Ryker said the draft 2025 list and methodology reflected advances in forecasting potential mineral supply chain disruptions.

“Minerals-based industries contributed over US$4 trillion to the US economy in 2024, and with this methodology we can pinpoint which industries may feel the greatest impacts of supply disruptions and understand where strategic domestic investments or international trade relationships may help mitigate risk to individual supply chains,” she said.

“This is a next generation risk assessment that can be used to prioritise securing the nation’s mineral supply chains.”

The supply chain disruption model assessed the potential effects of over 1200 trade disruption scenarios of 84 commodities on 402 individual industries and the US economy overall.

The top 10 mineral commodities, in descending order by the estimated probability-weighted impact of supply disruptions on the US economy, are samarium, rhodium, lutetium, terbium, dysprosium, gallium, germanium, gadolinium, tungsten and niobium.

It was suggested that the loss of even one critical mineral could disrupt entire industries.

The draft list is now subject to a 30-day comment period and submissions on the potential inclusion of metallurgical coal and uranium are sought.

Additions welcomed

Sun Silver (ASX: SS1) holds the US’ largest undeveloped silver project, the 480 million ounce silver equivalent Maverick Springs project in Nevada.

Managing director Andrew Dornan welcomed the news of silver’s potential inclusion on the list.

“From our perspective, we had a long-term view that it potentially would become a critical mineral globally, probably four years ago, given the emergence of its use in complex technologies and the energy transition, more than so as a traditional store of wealth and jewellery,” he said in an interview.

“I think it'll be really interesting to see how it plays out in the US now, because there is a significant number of projects which will be vying for critical mineral funding, however given we’re the largest pre-production, primary silver asset in the US, we feel like we’ll be right at the top of the list.”

The copper sector had been rallying for its inclusion on the List of Critical Minerals for some time.

Copper Development Association president and CEO Adam Estelle said the flow of US copper to market had been stymied by convoluted permitting, overreaching regulations, and a lack of strategic industrial policy to protect domestic producers from the “trade-distorting practices of China” and other non-market economies.

“The timing is crucial as the US needs to rapidly implement an ‘all-of-the-above’ sourcing strategy to meet the projected doubling of copper demand by 2035. This must involve increased domestic mining, refining, recycling, and continued trade with reliable partners,” he said in a statement.

“Today, USGS, Secretary Burgum and President Trump sent a strong signal that copper is critical to the United States of America. CDA and its members strongly believe copper should remain on the final 2025 list and stand ready to unleash American copper like never before.”

Trump meets BHP and Rio

The potential addition of copper on the list follows BHP (ASX: BHP) and Rio Tinto’s (LSE/ASX: RIO) visit to the White House last week.

Outgoing Rio CEO Jakob Stausholm, new CEO Simon Trott and BHP CEO Mike Henry met with Trump and Burgum in the Oval Office to discuss the Resolution copper project in Arizona.

“Resolution Copper is one of the largest untapped, high-grade copper resources in the US today and will create thousands of high value local jobs in Arizona and billions in economic activity across America,” Henry said following the meeting.

“As the world’s largest mining company and copper producer, I want to thank President Trump and Secretary Burgum for their strong leadership to reinvigorate mining and processing supply chains in and for America.”

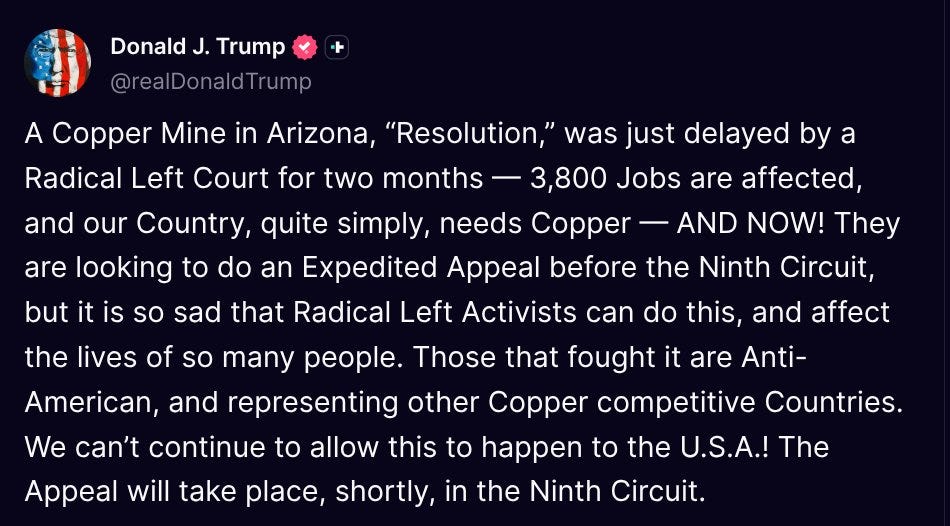

Only a day before the meeting, a US appeals court issued a temporary order, blocking the Trump Administration from transferring land required for the development to Resolution Copper, a 50:50 joint venture between BHP and Rio.

Trump expressed his outrage in a post to Truth Social.

Speeding up permitting

Resolution, which has been progressing the approvals process for nearly a decade, is one of a handful of mining projects to be added to the US’ FAST-41 program, which is aimed at speeding up project permitting as per Trump’s directive to accelerate domestic critical minerals production.

Perpetua Resources Corp’s (NASDAQ/TSX: PPTA) Stibnite gold-antimony project in Idaho is also part of the program.

After nearly eight years, the project was awarded its final federal permit in May.

“As we celebrate receiving the final federal permit for the Stibnite gold project, we applaud the National Energy Dominance Council and the Permitting Council’s efforts to streamline permitting and propel critical mining projects nationwide,” Perpetua CEO Jon Cherry said.

“We believe this administration’s commitment to boosting efficiency without compromising rigorous environmental standards can have a transformational impact on American mining."

Earlier this month, Equinox Gold Corp (TSX: EQX) announced that the second phase of its Castle Mountain project in California had been accepted into the FAST-41 program.

The company believes the permitting process for the proposed 200,000 ounce per annum project will be completed by the end of next year.

“With FAST-41 permitting status in place we've initiated study updates and project optimisation to align with the permitting timeline and position the project for a timely construction decision,” Equinox CEO Darren Hall said.

Orla Mining’s (TSX: OLA) US$190 million South Railroad heap leach project in Nevada has been in the permitting process for more than five years but was selected as a FAST-41 project.

Orla chief operating officer Andrew Cormier told a conference call earlier this month that the company was expecting the Notice of Intent to be published within weeks.

“Following the receipt of the Notice of Intent, we expect the Record of Decision in 2026, which will allow construction to start with commissioning in Q4 2027 and gold production in early 2028,” he said.

After Paramount Gold Nevada Corp’s (NYSE American: PZG) Grassy Mountain project was selected as a FAST-41 project, the company has already seen an improvement to permitting timelines, with the Bureau of Land Management releasing its draft Environmental Impact Statement earlier this month.

The project has been in permitting for more than 11 years.

“We appreciate the on-going support from the BLM in navigating through an evolving permitting landscape, and the transparency of the FAST-41 program for providing the clarity and accelerated timeline to receive the final EIS and ROD, expected later this year,” Paramount CEO Rachel Goldman said.