First big gold deal of the year announced

Enlarged company set to be Canada’s second-largest gold producer

Equinox Gold Corp (TSX: EQX) and Calibre Mining Corp (TSX: CXB) announced a merger on Sunday night, Canadian time, which will create Canada’s second-largest gold producer.

The two companies will combine via a “zero premium” plan of arrangement. Equinox will issue 0.31 of a share for every Calibre share held, representing a 2% premium to Calibre’s 20-day volume-weighted average price.

The implied market capitalization of the combined company is estimated at C$7.7 billion.

The enlarged company will retain the Equinox name and be owned 65% by Equinox shareholders, with the balance to be held by Calibre shareholders.

The new Equinox will comprise six directors from Equinox and four from Calibre, including Equinox chair Ross Beaty as chair and Blayne Johnson and Doug Forster from Calibre.

Equinox CEO Greg Smith will continue in the role, with Calibre CEO Darren Hall to be appointed as president and chief operating officer.

The combined company will have cash and equivalents of around US$486 million, including U$75 million of convertible notes to be issued by Calibre to Equinox, Vestcor Inc and Trinity Capital Partners, US$105 million in available credit and an undrawn accordion facility of US$100 million.

Drawn debt will be US$1.43 billion.

‘Size matters’

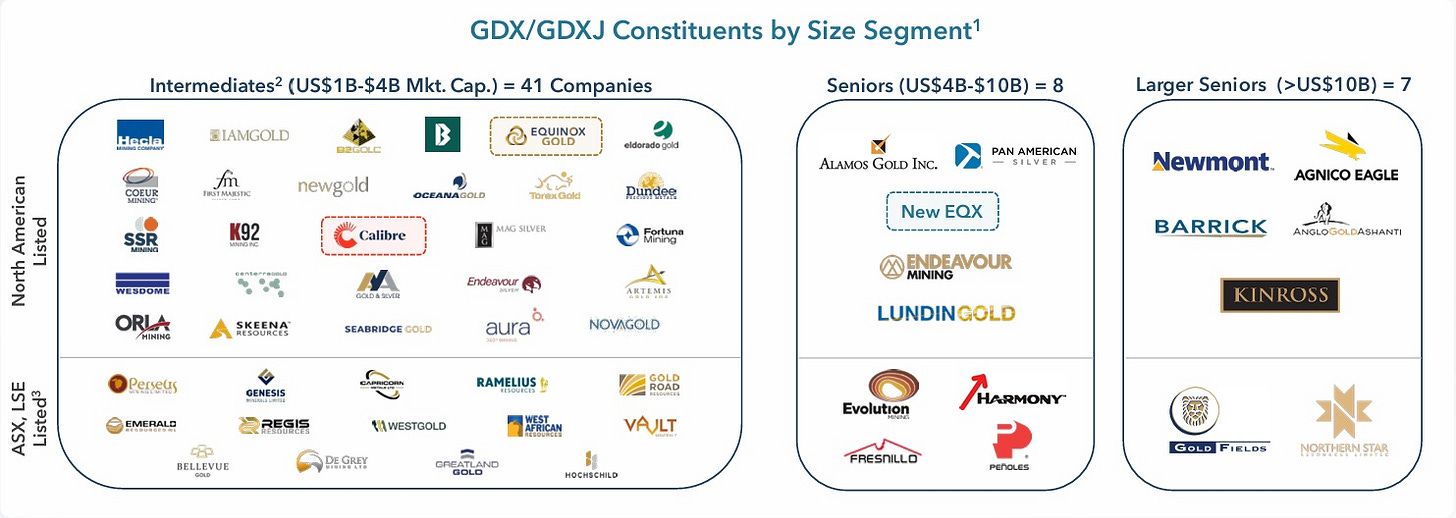

Speaking on a conference call on Monday morning, Beaty said the enhanced scale of the company would appeal to passive investors, including ETFs.

He said Equinox’s goal since its inception in 2018 was to “get big quickly” in order to offer the best possible leverage to the gold price.

“All the bullish reasons to support gold’s price today remain intact, and in this bullish gold price environment, how can we deliver superior value to equity investors? By increasing our gold production as much as possible, and by increasing our reserves and resources as much as possible,” he said.

Beaty said the enlarged producer would generate “astonishing cashflow”.

“Size matters. I’m convinced that this deal will make Equinox Gold into one of the world’s largest and best leveraged gold producers with a wonderful suite of growth projects and a great management team poised to deliver phenomenal value over the long term.”

Americas-focused producer

The enlarged company will have nine operating mines, as well as one in construction, plus five expansion projects.

It will have roughly 24 million ounces of gold reserves and 22Moz of measured and indicated resources.

The centrepiece of the merger is Equinox’s new Greenstone mine in Ontario, which achieved commercial production in November, and Calibre’s Valentine project in Newfoundland & Labrador, which is targeting first gold in mid-2025.

“It’s a rare opportunity to combine two great new Canadian gold deposits at the start of their production lives into a single owner that will become one of Canada’s largest gold producers,” Beaty said.

“It will build financial strength, mitigate risk through better diversification, and generate amazing cashflow in the near future, and for many years to come.”

The company’s other assets will be in the United States, Mexico, Nicaragua and Brazil.

The two cornerstone assets in Canada are expected to produce 590,000 ounces of gold per year once at full capacity, making the enlarged Equinox the second-largest gold producer in Canada behind Agnico Eagle Mines (TSX: AEM).

Equinox produced 622,000oz of gold in 2024. Guidance for 2025 is 950,000oz not including contributions from Valentine or Equinox’s Los Filos mine in Mexico due to uncertainties around negotiations with local communities.

Re-rate potential

Smith said the merger should catapult the enlarged Equinox into the ranks of the senior gold producers.

The companies see the potential for annual production to grow to 1.38Moz by 2026.

Smith said that based on a gold price of US$2650 an ounce, the combined entity would generate annual EBITDA of just under US$2 billion in 2026, or US$2.41 billion at today’s spot price.

He said 53% of the merged company’s production would come from Canada, providing the potential for a re-rating.

“Producers of gold in Canada enjoy significantly higher P/NAV multiples than non-Canadian producers due to the strong reputation and the strong geopolitical standing of Canada,” he said.

Hall added that both of the Canadian operations were at the start of their lives.

“Neither of those assets have been re-rated in the market and that’s the opportunity for the combined company,” he said.

Beaty said once the transaction was completed, the portfolio would be rationalized though it was too soon to say which assets could be divested.