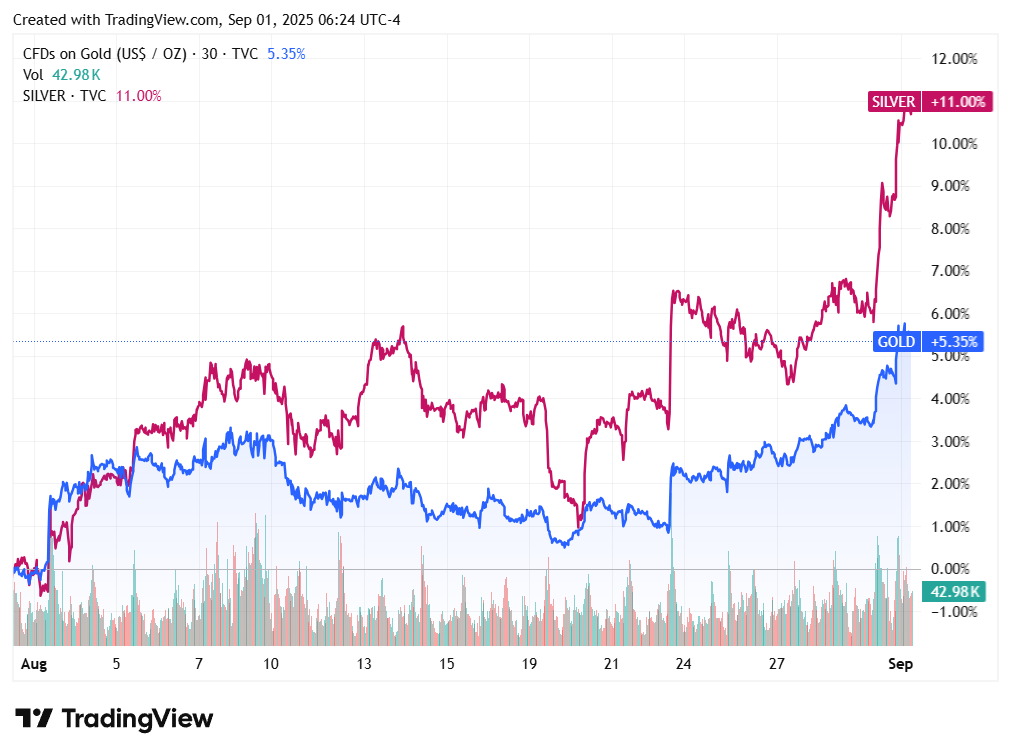

Gold and Silver Prices Roar into September

Gold at near record levels, while silver jumps to 14-year high

Precious metals have made a strong start to September, driven by geopolitical tensions, the increasing likelihood of a US interest rate cut and concerns over the independence of the US Federal Reserve.

Spot gold traded at above US$3480 an ounce on Sunday night/Monday morning US time, near April’s record high.

COMEX gold futures were trading at above US$3540/oz.

Meanwhile, spot silver rose above US$40/oz for the first time in 14 years, while the US dollar hit a five-week low.

During Monday trade in Sydney, gold miners accounted for four of the five biggest movers in the S&P/ASX 200 index with Capricorn Metals (ASX: CMM) and Genesis Minerals (ASX: GMD) each rising by more than 11%.

London-listed gold miners also opened higher in Monday trade, led by a 9% jump in Greatland Gold (LSE: GGP) shares.

Markets in the US and Canada are closed on Monday for the Labour Day holiday.

Further gains to come?

According to ANZ Research, gold’s surge on Friday was partially driven by escalating geopolitical tensions, which supported safe haven demand.

“A peace deal between Ukraine and Russia looks elusive, as both countries have continued to strike each other,” it said on Monday.

“Germany and France are pushing for secondary sanctions on nations supporting Russia’s war in Ukraine, targeting major buyers like China and India. This came after the US imposed 50% tariffs on India’s Russian oil imports.

“As part of ongoing tariff negotiations, Switzerland’s gold refiners have resisted to relocate some of their operations to the US to resolve trade imbalances between the two countries.”

Meanwhile, uncertainty over tariffs continued after a US appeals court ruled on Friday that most of President Donald Trump’s tariffs were illegal.

However, tariffs will remain in place until at least October as the case progresses to the US Supreme Court.

According to Citi, last week’s economic data did little to shift its expectations that the Fed would resume interest rate cuts this month.

“Final private domestic demand was revised higher to 1.9% in Q2, but details still reveal strength only in specific parts of the economy, such as investment that may be related to AI,” the bank said.

“Consumption continues to slow, particularly for services. Softer services demand leaves us expecting further slowing in services inflation, particularly as home prices decline on a monthly basis.

“A 0.27% increase in core PCE inflation in July was as expected, with strength due to financial services unlikely to repeat.”

Following the release of inflation data, Trump said “prices are ‘WAY DOWN’ in the USA, with virtually no inflation” in a post to Truth Social.

Citi suggested this week’s US jobs data could be more important.

“A further slowing to 45,000 jobs in August and the unemployment rate rising to 4.3% with upside risks [this] week should solidify a September rate cut, and likely a series of further cuts beyond next month,” it said.

“We continue to expect five consecutive 25bp cuts starting in September to a 3-3.25% policy rate.”

In the meantime, the uncertainty over the Fed’s independence continued amid Trump’s threats to fire Governor Lisa Cook.

Cook filed a motion for a temporary restraining order blocking her firing and a hearing took place on Friday, without a ruling.

Reuters quoted European Central Bank president Christine Lagarde as saying on Monday that if Trump fired Cook or Fed chairman Jerome Powell, it would represent a "very serious danger for the US economy and the world economy”.