Gold Bullion Market Upheavals Continue

Speculation abounds about the large quantities of physical gold being shipped to the United States.

Commentators and analysts continue to highlight the flow of 500 tonnes of gold to the USA in a short period, which has delayed deliveries and squeezed London’s vaults. The latest data shows that “Feb25 Comex gold "deliveries" have now exceeded 60,000 contracts and are almost certain to reach a record 70,000+. Over 200 metric tonnes!,” according to TF Metals Report.

The primary reasons for and impacts of the change in flows cited are:

Tariff Concerns: Fears of new tariffs have triggered the gold movement in anticipation of possible trade restrictions on precious metals. However, analyst Michael Lynch disagrees with the tariff angle:

“Most importantly, the rush to buy metal is driven by non-bullion banks. So far just one week into the February gold contract, over 2 million oz has transferred from bullion banks to customer accounts. That exceeds the entire total for any prior contract by more than a factor of 3….

…Things to point out … the net buying by customer accounts on the February contract at over 2.0 million oz has exceeded any other contract in comex history by more than 3X. In addition, the largest net sell by non-bullion banks was only 2 contracts prior. This 2 month change is enormous. …

… So, we’ve just seen the largest change in direction of customer moving from a strong sell to a record buy. This plot suggests a huge buy signal. As of yesterday’s comex reports, the buying deluge continues. I’ll bring you updates in the days to come.

Forgot to mention … tariffs have nothing to do with this. This is all about customer accounts at comex thirsty for metal.”

Tensions with Europe: The US and Europe are in conflict over how to end the Russia-Ukraine war. It is speculated that the US may be repatriating gold on fears that London-based reserves could be targeted by the EU, which believes Russia can be defeated militarily, while the new US administration is pushing for a negotiated settlement.x

Strategic Repositioning: There is speculation that the threat of auditing US gold reserves is a reason for the repatriation, as the gold was loaned or sold short by prior administrations and has to be restocked. Related speculation is that the flows may be anticipating some form of US gold-backed bonds or other instruments to counter the BRICS bloc threat to the American dollar as numeraire.

BRICS nations have significantly increased their gold reserves and production over the past two decades in a tandem strategy to bolster financial stability, reduce dollar dependency, and build a tangible asset foundation to back potential new financial systems or currencies. Collectively, BRICS countries control over one-fifth of the world's monetary gold reserves, with Russia and China alone accounting for a significant portion. There is speculation that the BRICS countries are looking to settle trade balances in gold as a first step.

Gold repatriation has been a theme in recent years, notably:

Germany: Notably, Germany repatriated a significant portion of its gold reserves from the U.S. and France, aiming to have half of its reserves stored domestically. This move was partly influenced by a desire to assure its citizens of the security of its reserves post-financial crises.

Hungary: For the first time in 31 years, it brought back all of its gold reserves from the Bank of England while announcing that it had increased its gold holdings 10-fold from 3.1 to 31.5 tonnes. According to the World Gold Council, Hungarian gold reserves reached an all-time high of 94 tonnes in the first quarter of 2021.

Serbia: In November 2019, the country purchased nine tonnes of gold and has accumulated an estimated 41 tonnes by the start of this year.

Romania: In April 2019, it repatriated 60% of 103.7 tonnes stored at the Bank of England. A new law stipulated that only 5% of its gold could be kept abroad.

Netherlands: In 2014, the Dutch Central Bank brought 122.5 tonnes of gold from New York to Amsterdam, citing benefits during financial crises.

Venezuela: Before 2012, Venezuela moved 160 tons of its gold back from foreign banks to its home country under President Hugo Chávez's directive, aiming to centralize control over national assets.

Ghana: More recently, Ghana has been highlighted for strategic reasons to repatriate its gold from the U.S., aiming to safeguard against economic volatility.

Market Impact: The physical relocation of gold has reportedly created liquidity challenges worldwide, especially in London, with the Bank of England experiencing backlogs in gold withdrawals. This has raised borrowing costs for gold in London (lease rates as high as 12% compared with the normal 2-3%) as market players seek to lease gold from central banks to meet demand. American sources report that the "incredible demand for physical gold" in New York markets is creating price disparities between NY and London.

Gold trading hubs in Hong Kong and Dubai are reportedly being tapped for deliveries to ease pressure on London.

Bloomberg News reports that South Korea’s mint has halted gold bar sales due to tight supplies.

X user FinanceAlot reports that 2-4 tons of gold is being flown to the USA on each commercial flight from London to US destinations. It is reported that COMEX deliveries require 393 tonnes to settle, which has created fulfillment backlogs of 6-8 weeks.

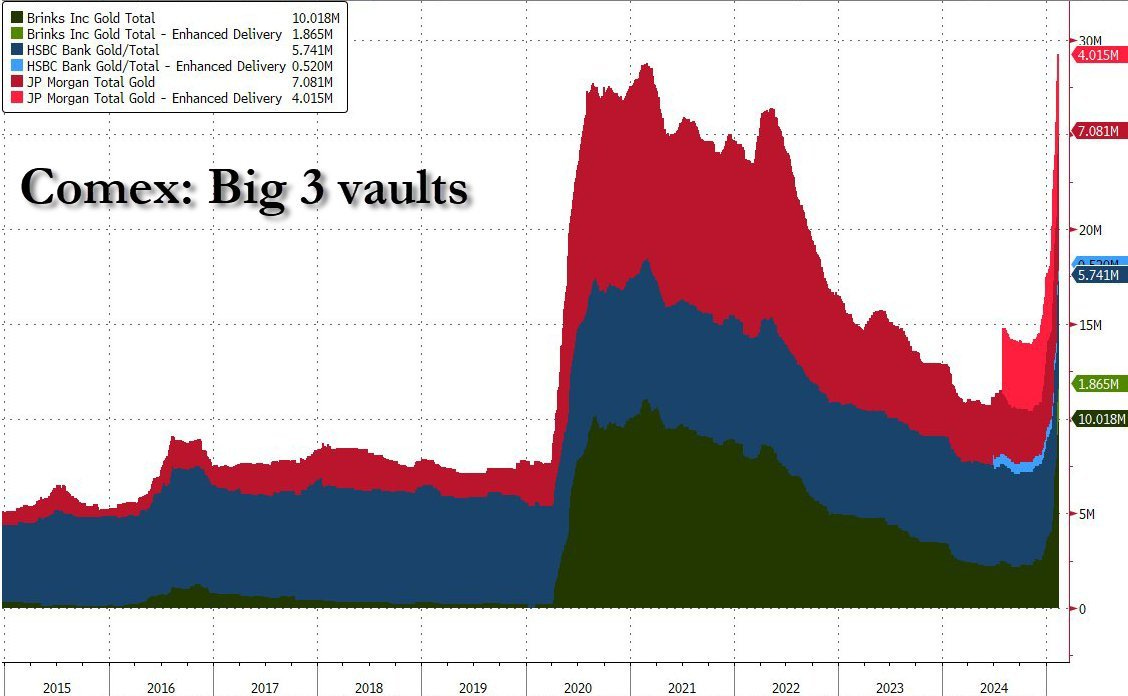

One day of gold buying drove COMEX's gold delivery into record territory, with settlements exceeding COMEX's year-end 2024 registered gold over the last six weeks.

See you in Zürich in early April

All these issues and the benefits for precious metal producers will be discussed at the European Mining Forum, which convenes in Zürich from March 31 to April 2, 2025. Qualified investors are welcome to attend at no charge. Follow the link to see the agenda and opportunities for direct engagement with senior management from the mining companies.