Gold Forum Americas - Day 2. The Senior Companies Take the Stage with M&A in the Spotlight

The Morning Note from Victor Flores

For better or worse, the gold mining industry has relied on M&A to replenish the project pipeline and grow its production. Because of this, the Gold Forum Americas is rife with conversations about the next deal, particularly among senior gold miners. However, given the pushback from investors over deals gone wrong and the increased focus on capital allocation, the companies have become much more tactical about their M&A decisions. This has led to a dynamic where some companies are eschewing inorganic growth, others are busy digesting recent acquisitions, and some have just announced deals that could well determine the future of the company.

AngloGold Ashanti

Presentation Video

AngloGold [Profile] recently announced the acquisition of Centamin [Profile] in a cash and stock deal that values the target at USD 2.5 billion. The transaction valued Centamin at a 36.7% premium. Centamin’s key asset is the Sukari mine in southern Egypt, a combined open pit and underground gold mine that is anticipated to produce between 470,000 and half a million ounces in 2024 at an all-in sustaining cost (AISC) of USD1200-1350 per ounce. Sukari is expected to see a reduction in expenses with the completion of the connection to grid power, which will complement the solar power plant and eliminate the use of diesel for power generation. Beyond Sukari, Centamin has the Doropo project in the Ivory Coast, which could add a further 200,000 ounces of annual production. This can be seen as a bolt-on transaction for AngloGold, adding a Tier 1 asset that could, in time, allow the company to part with some of its non-core assets.

Newmont Mining

Following the acquisition of Newcrest, Newmont [Profile] is now rationalizing its portfolio. The sale of the Telfer mine and Haverion project to Greatland Gold [Profile] for USD 475 million has kickstarted that process, and the market now awaits news on the sales process for its non-core North America and African assets. The company anticipates completing the sale of the Akyem mine in Ghana and the North American assets by the second quarter of next year. Significantly, Newmont anticipates achieving total sales proceeds of some USD 2 billion, a not insignificant sum that can then be redeployed into new projects such as Ahafo North. It is unlikely that Newmont will be on the hunt for new assets shortly, given the rich pipeline of projects it has accumulated with the purchases of Goldcorp and Newcrest.

Barrick Gold

Barrick [Profile] has signaled that it intends to avoid the M&A game, and the company’s CEO, Mark Bristow, chastised the industry for underspending on exploration. In his view, the industry’s pipeline is bare because of cuts to exploration budgets, leading to M&A as an expensive alternative to organic growth. The focus is now on those organic opportunities, including the Goldrush and Fourmile projects in Nevada, the Lumwana expansion in Zambia, and the controversial Reko Diq copper-gold project in Pakistan. Barrick highlighted that its financial discipline has allowed it to return USD 5 billion to shareholders over the past five years.

Gold Fields

Gold Fields is [Profile] busy ramping up its Salares Norte project in Chile, which, when at total capacity, will produce 550,000 to 600,000 ounces per annum. The startup was delayed by an unusually harsh Andean winter but will begin producing as Spring arrives in the southern hemisphere. This, however, did not stop Gold Fields from announcing that it would be acquiring Osisko Mining [Profile] to get the other 50% of the Windfall project in Ontario that it did not own (GFI has previously entered into a deal with Osisko to earn a 50% interest). The company believes that Windfall is geologically similar to its St. Ives mine in Australia, an asset that has been a long-term producer.

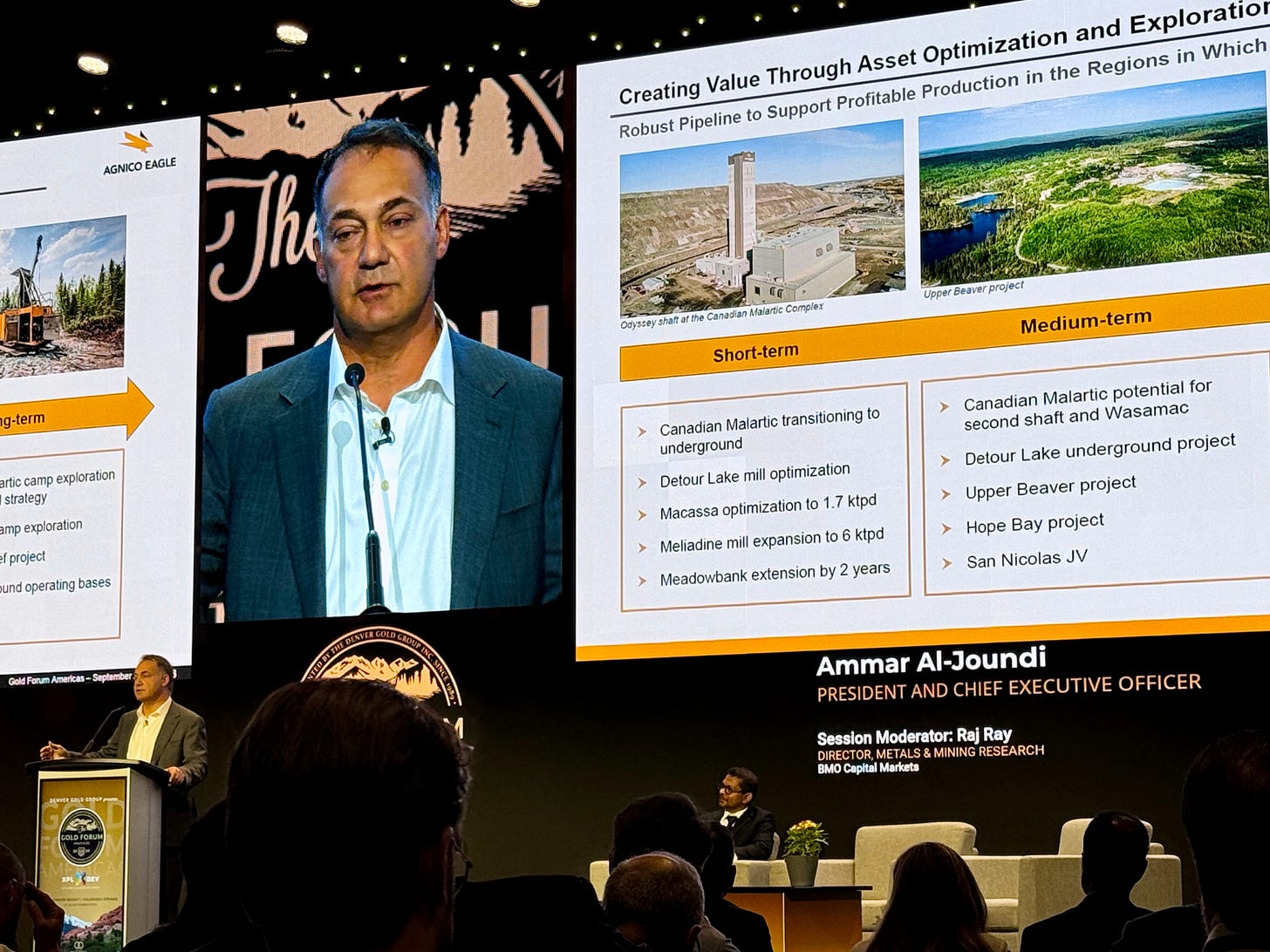

Agnico-Eagle

Agnico [Profile] has deftly grown its business through targeted M&A and is now reaping the rewards of those deals. Both the Detour mine in Ontario and the Malartic mine in Quebec could each produce one million ounces annually if the mooted expansions go ahead, so there seems to be limited prospects for deal-making in the foreseeable future. But Agnico is always on the hunt for new opportunities in those regions where it operates, which the company has made clear is limited to areas where it already has a dominant position and to a handful of safe jurisdictions.

Kinross

The acquisition of Great Bear has put Kinross [Profile] in the spotlight because it bought the asset for about USD1.4 billion even though it was still at a reasonably early stage; essentially, the company was willing to buy the Dixie project on the belief that it had correctly interpreted the project’s geology. Almost three years later, the company published a preliminary economic assessment that indicates annual production of 500,000 ounces per year at an AISC of USD 900 per ounce with a capital cost of around USD 1.4 billion. The company is working on the baseline data for federal environmental permitting and expects to begin driving an exploration ramp as soon as it receives provincial approval. The project could be in production in the second half of 2029.

Northern Star

Northern Star [Profile] is another company that has grown rapidly via acquisition and is now digesting and optimizing its acquired assets. The focus is on expanding the processing facility at Kalgoorlie, which will take capacity from 13 million tonnes per annum to 27mtpa, doubling production to 900,000 ounces per annum. Interestingly, the company provided some interesting statistics that show both the power of acquiring unwanted assets and the risks. On the positive side of the ledger, Northern Star acquired the Jundee mine for AUD 87.5 million and, ten years later, generated AUD 2.2 billion in free cash flow. The USD 260 million acquisition of the Pogo mine in Alaska in 2018 has resulted in free cash flow to date of USD 149 million, so the company will have to make this asset sweat to get its money back.

Zijin Mining

Zijin Mining [Profile] is less well known among Western investors, but it has become a powerhouse global producer via aggressive M&A. This year, the company expects to produce 2.3 to 2.4 million ounces of gold and 1.1 million tonnes of copper. Having started life as a regional gold producer, it has acquired gold assets in Colombia, Suriname, and Australia and copper assets in the Democratic Republic of Congo and Serbia. It was noted that many of these assets are on the small side, so it would not be surprising to see additional transactions to upgrade the portfolio, especially in the developing world. The CEO appealed for ongoing openness to market-based transactions without political interference, a reference to the pushback the company has received for certain transactions. In closing, one would hope this sentiment reverberates, and the gold industry is free to carry on with M&A. Ultimately, it is up to the shareholders to determine whether these transactions create value and should proceed.