Miners’ Warnings Realized: Precious Metals at Historic Highs After Fed Cut

A Look at metal price, demand, and supply stories from Mining Forum Americas 2025

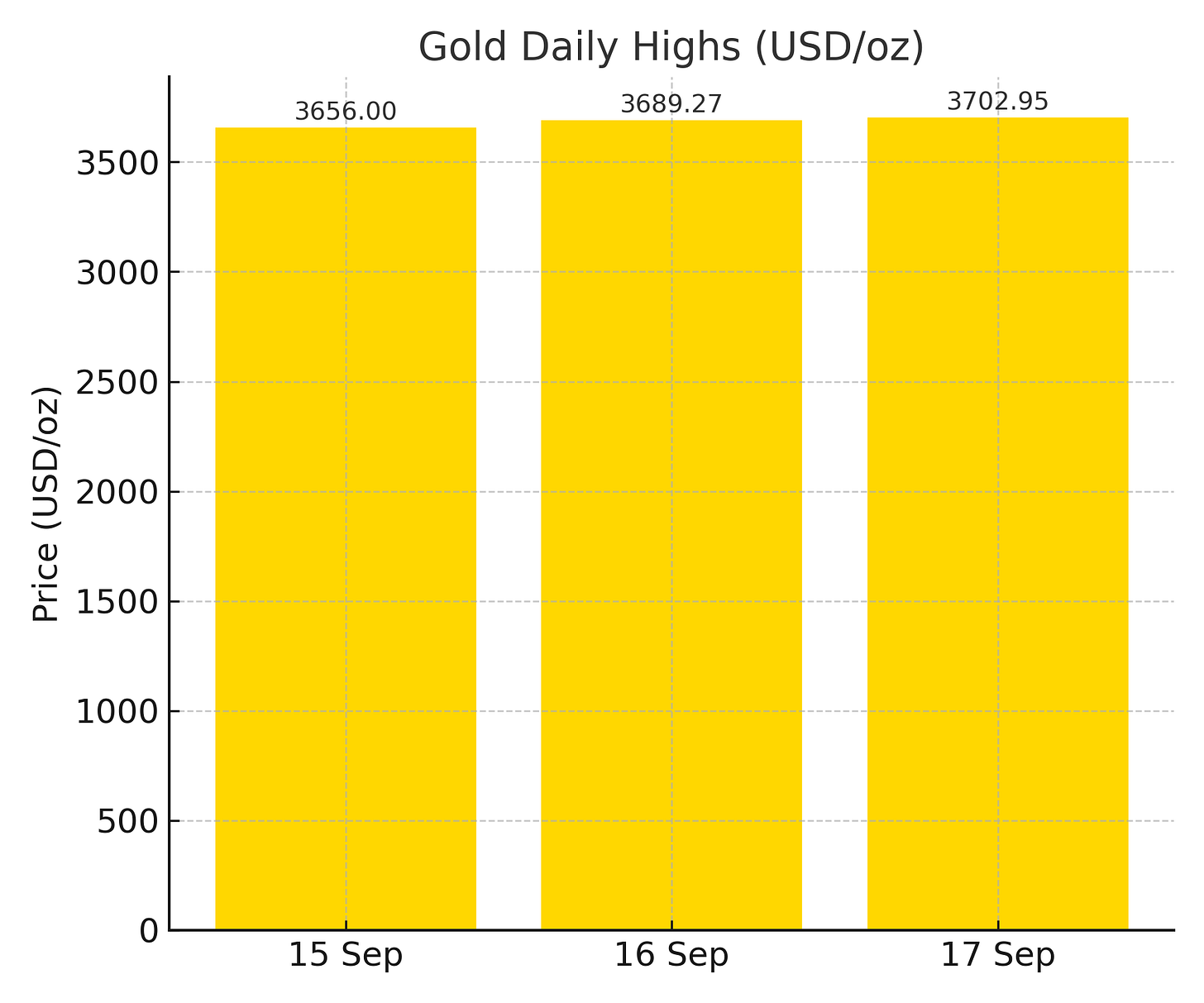

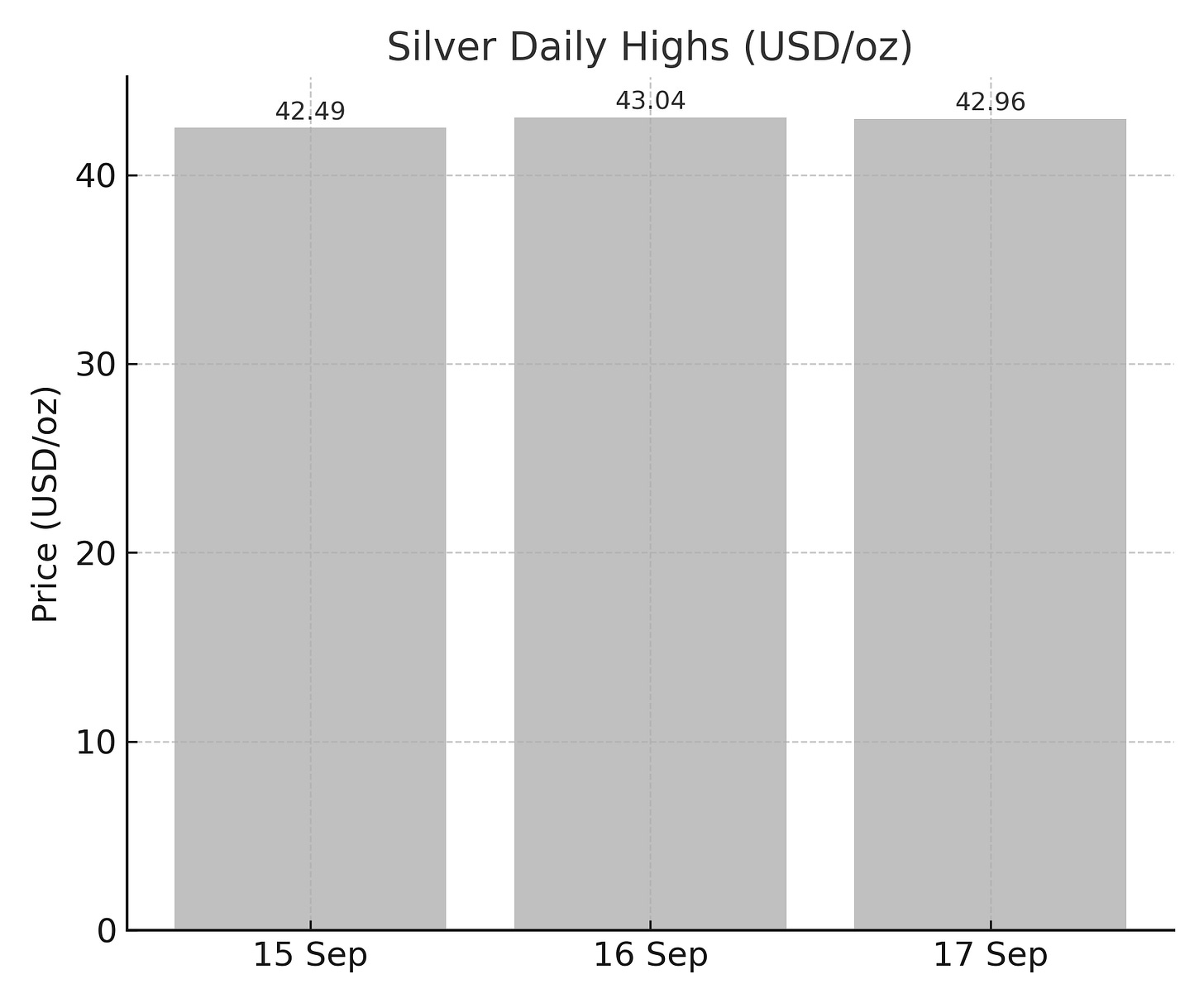

The Federal Reserve’s September rate cut has triggered a dramatic rally in metals, sending gold and silver to new nominal and real highs. Gold spiked to $3,702.95/oz on September 17, while silver surged past $43/oz, extending its strongest run in more than a decade.

For attendees of Mining Forum Americas 2025 (Sep 14–17, Colorado Springs), the rally felt like a vindication: many companies presenting at the event had already warned of tight supply, mounting demand, and the likelihood of a structural bull market in metals.

Gold: Safe Haven With Expanding Margins

Franco-Nevada reminded investors that since Bretton Woods, gold has appreciated at roughly 9% annually against the U.S. dollar. Their forward-looking target of $5,700/oz within five years now seems less aspirational and more inevitable.

Agnico Eagle stressed that in 2025, gold had risen by $1,100/oz year-to-date, while their costs rose only $10/oz — capturing 99% of margin expansion. At today’s prices, their margins exceed 60%, an extraordinary level even by gold bull market standards.

Several executives underscored the role of central bank and sovereign buying, noting that gold is the first port of call in uncertain geopolitical and macro environments. A streaming CEO predicted $4,000/oz gold in 2025/26, highlighting ongoing retail adoption as digital gold ownership platforms mature.

Silver: Deficits and Critical Mineral Status

Mining Forum presenters widely anticipated silver’s breakout above $40/oz:

Pan American Silver pointed to silver’s cyclical lag — it follows gold’s lead, but often outpaces it in percentage gains. Their reserves are heavily silver-weighted, positioning them for upside as silver closes the gap.

First Majestic Silver painted a stark picture: global production of 830M oz versus demand of 1.2–1.3B oz, creating a 150M oz deficit in 2024. They argued it would take “ten brand new First Majestics” to balance the market — an impossibility in the short run.

An executive from a silver-focused developer described silver as a true “critical mineral”, essential for solar power, electronics, and water purification. Industrial consumption, layered on top of rising retail demand, adds structural weight to silver’s case.

Copper and Transition Metals: The Other Bull Market

Zijin Mining offered perhaps the most direct link between policy, demand, and strategy. With copper already contributing 45% of group profits, Zijin pointed to the global energy transition as a structural driver of demand for copper and lithium. They argued that electrification and renewables will keep these metals in structural deficit “for years to come.”

Seabridge Gold (KSM project) demonstrated the economic power of high copper and gold prices: at current spot levels, their first five years of output would generate $25 billion EBITDA, more than double their base-case assumptions. Even if capital costs rise, metal prices provide a powerful cushion.

Copper, like silver, is increasingly framed not just as a commodity but as infrastructure for the energy transition — a narrative that dovetails with the policy environment supporting today’s rally.

From Forecasts to Fulfillment

When executives at Mining Forum Americas warned of deficits, industrial pull, and monetary demand, it may have seemed like standard conference rhetoric. But with today’s Fed cut driving real rates lower, their words ring prophetic:

Gold is fulfilling its safe-haven role, with institutions and retail buyers alike flooding in.

Silver’s chronic supply deficits are colliding with new highs in industrial demand.

Copper and lithium are no longer just cyclical plays, but central pillars of the energy transition.

Outlook: Beyond Today’s Rally

If further rate cuts follow, as markets expect, $4,000 gold and triple-digit silver are no longer far-fetched.

Central bank buying will remain a steady anchor of support.

Supply bottlenecks in silver and copper will take years — not months — to resolve.

The Mining Forum Americas 2025 will be remembered as a moment when miners’ long-term narratives converged with macro reality, ushering in a new chapter of historically high — and possibly still rising — metal prices.