Permitting, Partnerships, and Financing Define the Next Wave of Large Gold Projects

How six gold developers are navigating jurisdictional hurdles, innovative financing, and community partnerships to advance the next generation of mines.

Overview of Key Themes

The presentations at Mining Forum Americas 20025 from Dakota Gold [DC:US, $4.90, $550.5M], Montage Gold [MAU:CN, $4.49, $1.6B], i-80 Gold [AUX:CN, $0.92, $750.2M], NovaGold [NG:US, $7.30, $3.0B], Seabridge Gold [SEA:CN, $20.27, $2.1B], and Perpetua Resources [PPTA:US, $18.01, $1.9B] reveal several overarching themes in the current mining landscape:

Capitalizing on high gold prices,

The critical importance of jurisdiction and permitting,

Diverse and innovative financing strategies, and

A strong emphasis on social license and environmental stewardship.

While all companies address these themes, their specific circumstances lead to pronounced differences in their strategies and execution.

1. Development Pathways: Speed vs. Scale and Complexity

A primary differentiator among the companies is their development strategy and timeline, which is heavily influenced by the nature of their assets and their location.

Commonalities: Most companies are in a development or pre-development phase, moving their flagship assets toward production by advancing feasibility studies, securing financing, and initiating construction activities. They all project strong economic returns, bolstered by the current high gold price environment.

Differences in Approach and Execution:

Rapid Execution in Africa: Montage Gold highlights the speed of its African project, noting that the time it takes to get a permit in North America can be equivalent to moving from discovery to production in Africa. It is pursuing an aggressive strategy of simultaneous construction and exploration, having started its build less than a year after securing financing, while also drilling 120,000 meters to define higher-grade satellite deposits to optimize the initial mine plan.

Phased, Systemic Build-Out in Nevada: i-80 Gold presents a more complex, multi-phase plan to become a mid-tier producer by the early 2030s. Their strategy is a "hub and spoke" model, involving the sequential development of three underground mines feeding a central autoclave facility (Lone Tree), followed by two large open-pit mines. This approach is capital-intensive and requires a long-term, staged execution plan.

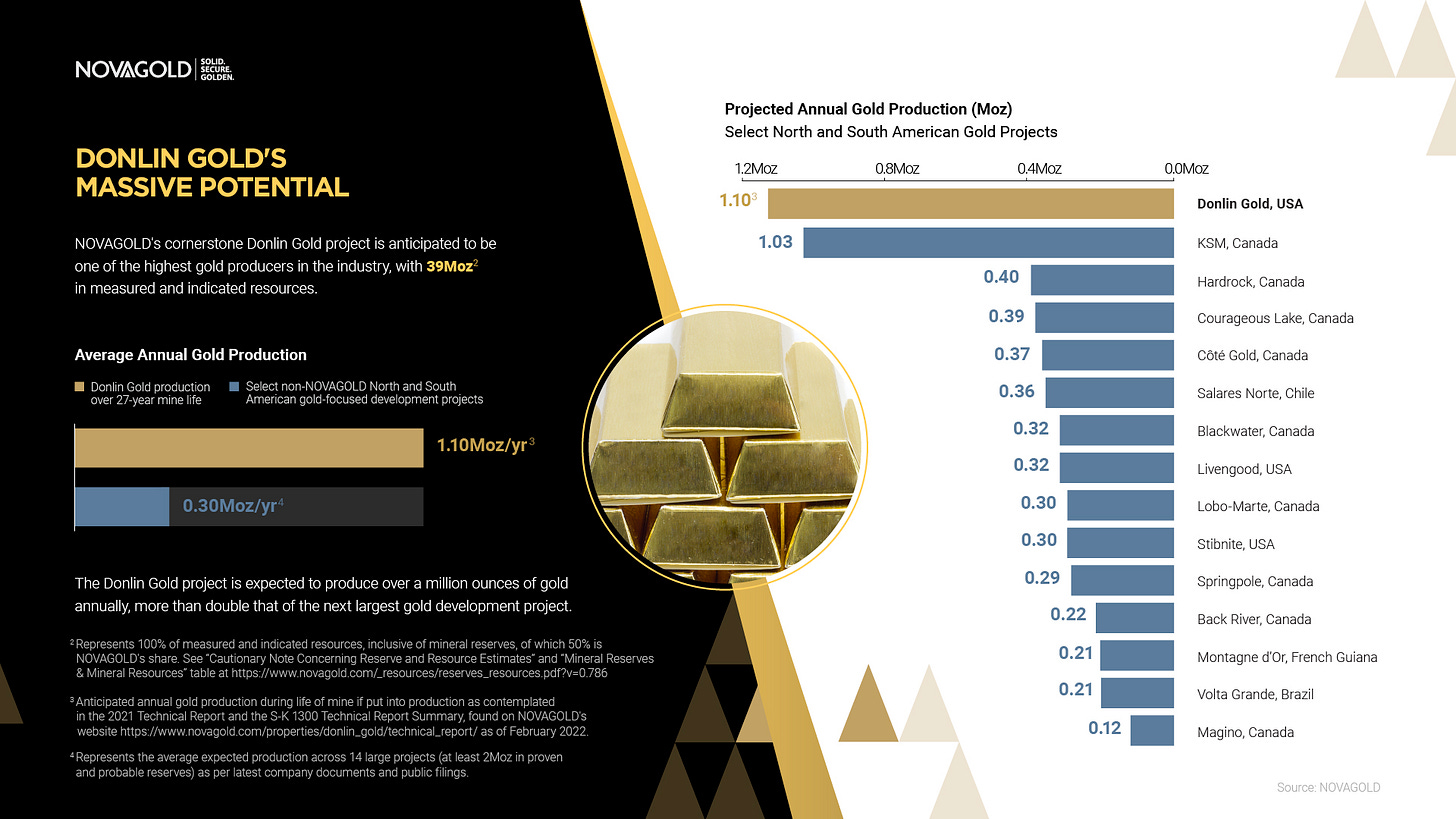

Catalyst-Driven Mega-Projects: NovaGold and Seabridge Gold [SEA:CN, $20.27, $2.1B] represent massive, world-class undeveloped assets that have required a specific catalyst to move forward. For NovaGold, the key was a change in partnership, bringing in Paulson & Co., who are aligned on advancing the Donlin project to a construction decision after years of stagnation. For Seabridge, the primary goal is securing a joint venture partner to help fund the enormous capital cost of the KSM project, which is the final piece of the puzzle after securing permits and starting early construction.

De-risked, "Shovel-Ready" Projects: Dakota Gold and Perpetua Resources represent more straightforward, de-risked development stories. Dakota Gold is advancing its Richmond Hill project towards a 2029 production target, leveraging existing infrastructure in a historic district and a low initial capital cost of $380 million. Perpetua is even further along, having all necessary permits and being fully financed to begin construction on what will be the highest-grade open-pit project in the US. Companies like Dakota Gold and NovaGold benchmark their potential against successful recent developers like Skeena Gold + Silver [SKE:CN, $18.68, $2.1B], whose share price performance is highlighted as a model for value creation as projects advance towards construction.

2. Jurisdiction, Permitting, and Social License

The geographic location of each project profoundly shapes its risks, opportunities, and narrative.

Commonalities: All companies emphasize operating in favorable jurisdictions and the importance of securing and maintaining a social license to operate through community engagement and environmental responsibility.

Differences in Approach and Execution:

Leveraging Private Land: Dakota Gold repeatedly stresses that its primary projects are on private land in South Dakota, which simplifies and clarifies the permitting process. Their team has deep local ties and experience with state regulators, which they see as a key advantage.

Restoration as a Core Value Proposition: Perpetua Resources has a unique approach where environmental stewardship is central to its investment case. The project is located on an abandoned brownfield site, and their plan involves using modern mining to fund and execute extensive environmental restoration, improving water quality and fish passage. This has garnered significant government support.

Partnership with Indigenous Peoples: Both NovaGold and Seabridge operate on or near lands with significant Indigenous interests. NovaGold's project is on private land owned by two Alaska Native Corporations who are partners and "staunch advocates for the project". Seabridge highlights that its application for a "substantially started" designation on its permits was accompanied by strong letters of support from First Nations.

Permit Defense as a Key Activity: NovaGold and Seabridge, having secured major permits for their large-scale projects, are now actively defending them against legal challenges from environmental groups and a small First Nation, respectively. This contrasts with companies like Dakota Gold and Montage, who face a more straightforward path.

3. Financing and Capital Strategy

The methods used to fund these large projects vary significantly, reflecting different capital requirements, risk profiles, and shareholder structures.

Commonalities: All companies are focused on financing their development plans while minimizing shareholder dilution and maximizing per-share value.

Differences in Approach and Execution:

Comprehensive Government-Backed Financing: Perpetua stands out with its robust and complete financing package. This includes a recent $459 million equity raise, a pending royalty/stream transaction, and crucially, a preliminary letter from the US EXIM bank for up to $2 billion in debt financing, driven by the project’s strategic importance for antimony production.

Innovative, Multi-Source Structure: Montage Gold has assembled a complex $950 million package that includes debt, a subordinated redeemable stream, and equity. This structure was designed to minimize dilution and maximize NPV per share, allowing for over 90% leverage on the asset. The stream is novelly structured to apply only to the initial two deposits, leaving exploration upside unencumbered.

Recapitalization and Portfolio Management: i-80 Gold is in the process of a "strategic recapitalization plan". After an initial equity raise to fund technical work, it is now seeking $350-$400 million in debt and considering the sale of non-core assets or a royalty on its flagship Mineral Point project to fund its Phase 1 development.

JV Partnership as the Primary Goal: Seabridge, with its multi-billion dollar KSM project, is not seeking traditional financing but is instead in the final stages of selecting a major joint venture partner to fund the project into production.

Support from a Major Shareholder: Dakota Gold benefits from a low capex of $380 million and has a proposal for up to $300 million in financing from Orion, one of its major shareholders, significantly de-risking its path to production.

4. Growth and Exploration Strategy

While all companies possess significant resources, their approach to growing them varies from aggressive, near-term expansion to longer-term, systematic development.

Commonalities: Every company emphasized that its deposits are open for expansion and that there is significant exploration potential on their land packages.

Differences in Approach and Execution:

Exploration-Fueled Growth: Montage is actively exploring and building in parallel, with the stated goal of finding a million ounces at higher grades before production starts to immediately enhance the mine plan. It also has a unique strategy of taking strategic stakes in other junior explorers in West Africa, creating a broader exploration portfolio.

Unlocking a Portfolio: i-80 Gold's growth comes from developing its existing pipeline of five assets. The focus is on converting inferred resources to reserves and executing the phased development plan rather than greenfield exploration.

Systematic De-risking: Dakota Gold's strategy is to focus on bringing its Richmond Hill project into production first, using its future cash flow to then advance its second major asset, the Maitland project.

Spin-outs and New Discoveries: Seabridge, in addition to developing KSM, plans to unlock value by spinning out its Courageous Lake project into a separate public company. It is also actively exploring its Iskit property, where it believes it has a major new discovery in the works that could become its fifth multi-billion-ton deposit.