Ramelius and Genesis Aiming to Fill the ASX Gap

The two Aussie mid-tiers vying to move closer to Northern Star and Evolution

Western Australian mid-tier producers Ramelius Resources (ASX: RMS) and Genesis Minerals (ASX: GMD) are each looking to become the ASX’s third-largest gold producer by market capitalisation.

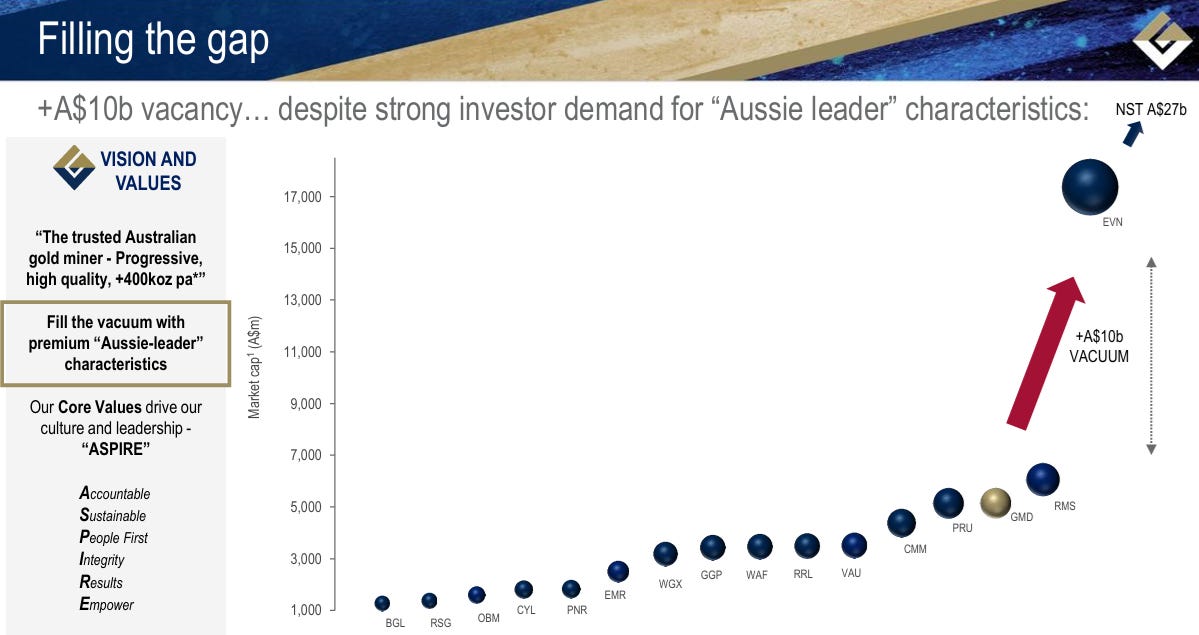

While Newmont Corporation (ASX: NEM) has an ASX listing, the bourse’s largest homegrown producer is Northern Star Resources (ASX: NST), with a market cap of a record A$32 billion as of Monday’s close.

The second largest is Evolution Mining (ASX: EVN) with a market cap of just over A$20 billion, also a new record, but there’s a significant gap below Evolution.

Ramelius, with a market cap of A$7.1 billion, and Genesis, valued at A$6.5 billion are each looking to move closer to Evolution.

Both joined the S&P/ASX 100 index on Monday and hit all-time share price highs.

Ramelius Resources

It was Ramelius managing director Mark Zeptner’s 10th presentation to the Mining Forum Americas in Colorado Springs last week and he reflected on the company’s journey from junior producer to mid-tier.

“Back in 2016, I talked about a pathway to 150,000 ounces,” he said.

“This year, we're talking about a pathway to 500,000 ounces, so times have changed.”

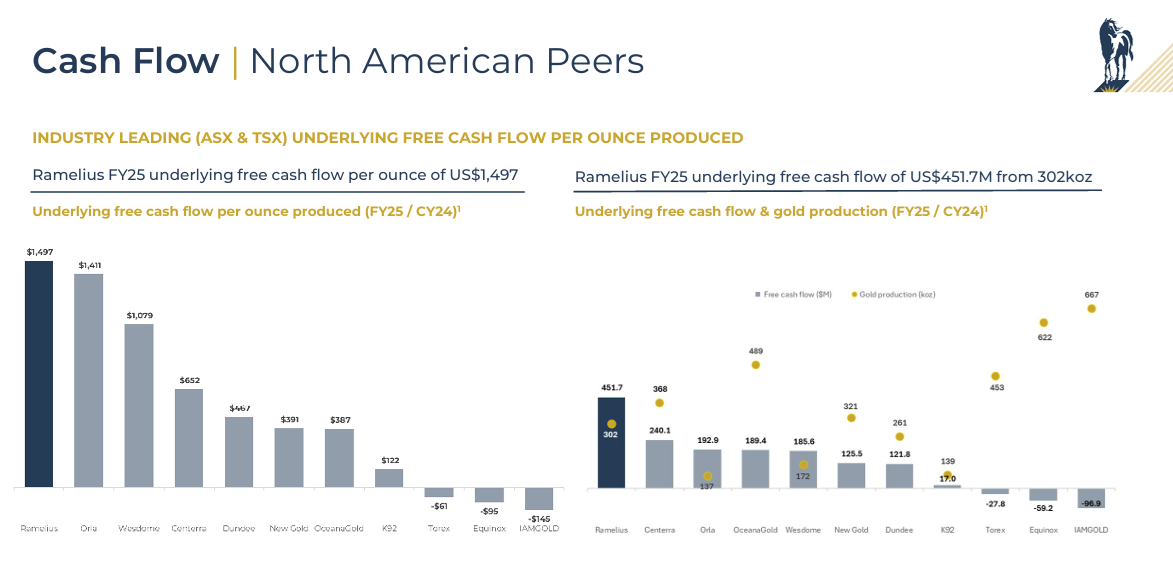

In the 12 months to June 30, Ramelius produced 302,000oz of gold at all-in sustaining costs of A$1551 an ounce, or US$1008/oz, at an “industry leading” EBITDA margin of 68%.

“FY25, as everybody knows, was a great year for Ramelius – over 300,000oz for the first time, generating sector leading cashflows per ounce, a fifth year of achieving both production and cost guidance,” Zeptner said.

“Our understanding is that no other ASX producer has been able to achieve that.”

Ramelius reported full year underlying free cashflow of US$451.7 million and underlying free cashflow per ounce of US$1497/oz, bettering many of its North American peers.

“If cashflow’s not your thing, then maybe capital returns are,” Zeptner said, pointing out that Ramelius led the same peer group in terms of return on capital, return on invested capital and return on equity.

“I have to admit, I was a little surprised to be leading all three categories, but not when I think about it a bit further.

“Ramelius has generated excellent returns for modest capital investment for some period and when we've used our paper, we've generally done accretive deals to ensure the return on equity is high.”

The company recently closed the acquisition of Spartan Resources, which will allow it to add the Dalgaranga project to its Mt Magnet production hub.

The main attraction of Dalgaranga was the high-grade Never Never and Pepper discoveries, which have underground resources of 2.3 million ounces at 9.3 grams per tonne gold.

An integration plan for the Dalgaranga/Mt Magnet project will be released in the December quarter, along with the definitive feasibility study for the Rebecca-Roe project, outside Kalgoorlie, and an updated five-year plan.

“It is important to note that our five-year plan will be a base case, with the doubling of our exploration budget [to A$100 million], having the potential to improve the profile, particularly if we're able to extend any of our high-grade operations,” Zeptner said.

Genesis Minerals

Led by the team behind Saracen Mineral Holdings, Genesis has had a rapid ascension to the ASX mid-tier ranks.

“Since we presented here just last year, our market cap has more than doubled,” Genesis chief development officer Troy Irvin told the Mining Forum Americas.

“Our daily trading liquidity has more than doubled to A$20 million, and the number of brokers covering us has more than doubled to 14, so a big 12 months.”

Genesis has only been a producer for a little over two years since it acquired the Gwalia gold mine in Leonora from St Barbara (ASX: SBM) in mid-2023.

The company has since acquired Dacian Gold and its Laverton mill and more recently, Focus Minerals’ (ASX: FML) 4Moz Laverton project.

Genesis produced 214,000oz of gold in the 12 months to June 30, at AISC of A$2398/oz.

Guidance for the 12 months to June 30, 2026, is 260,000-290,000oz at AISC of A$2500-2700/oz.

The company expects to hit 300,000oz of annual production in the 2028 financial year and 350,000oz in the 2034 financial year.

Irvin stressed that the plan, released in March 2024, was a base case and was conservative, based on a gold price of A$2800/oz.

“We are targeting 400,000 ounces per annum, and that's what our Aspire 400 accelerated growth strategy is all about,” he said.

“It's about bringing ounces forward, driving progressive economics, so more volume, lower costs and more cashflow over time.”

The company is working on an updated plan to be released in the first half of next year.

“Potential elements of that new plan include updated cost assumptions, a staged plant expansion or staged plant expansions, depending which way we go, seeing our flagship Tower Hill deposit processed at an expanded Leonora mill, and we'll also look to deal in some of the recent assets acquired from Focus,” Irvin said.

The company also has 12Moz of resources not included in the 10-year plan.

Irvin said in the ASX context, only Northern Star and Evolution, received “true international billing” and there was a gap below them.

“At Genesis, we do harbour a mid-cap bias, so we see this vacuum as a sweet spot,” he said.

“So if you get in that vacuum, you're generally large enough to be relevant to investors, but you're also small enough to be nimble and still able to grow.

“The other thing is, investors love this space, so our Aspire 400 strategy aims to capitalise on this very opportunity.”