Tether, Gold, and the Quiet Re-Monetization of Bullion

Why physical gold is moving back into the monetary core, this time on digital rails

Introduction

Over the past decade, stablecoins have become a key part of global financial infrastructure, especially in regions with limited access to reliable banking or restrictions on capital movement. As a result, Tether’s flagship product, USDT, has become a leading medium of exchange, facilitating trillions of dollars in yearly transactions.

Less obvious but increasingly important is the evolution of Tether itself. What started as a fiat-backed payments tool has become a profit-generating powerhouse, with its balance sheet shifting away from reliance solely on sovereign currencies and toward non-sovereign hard asset reserves. At the core of this change is gold.

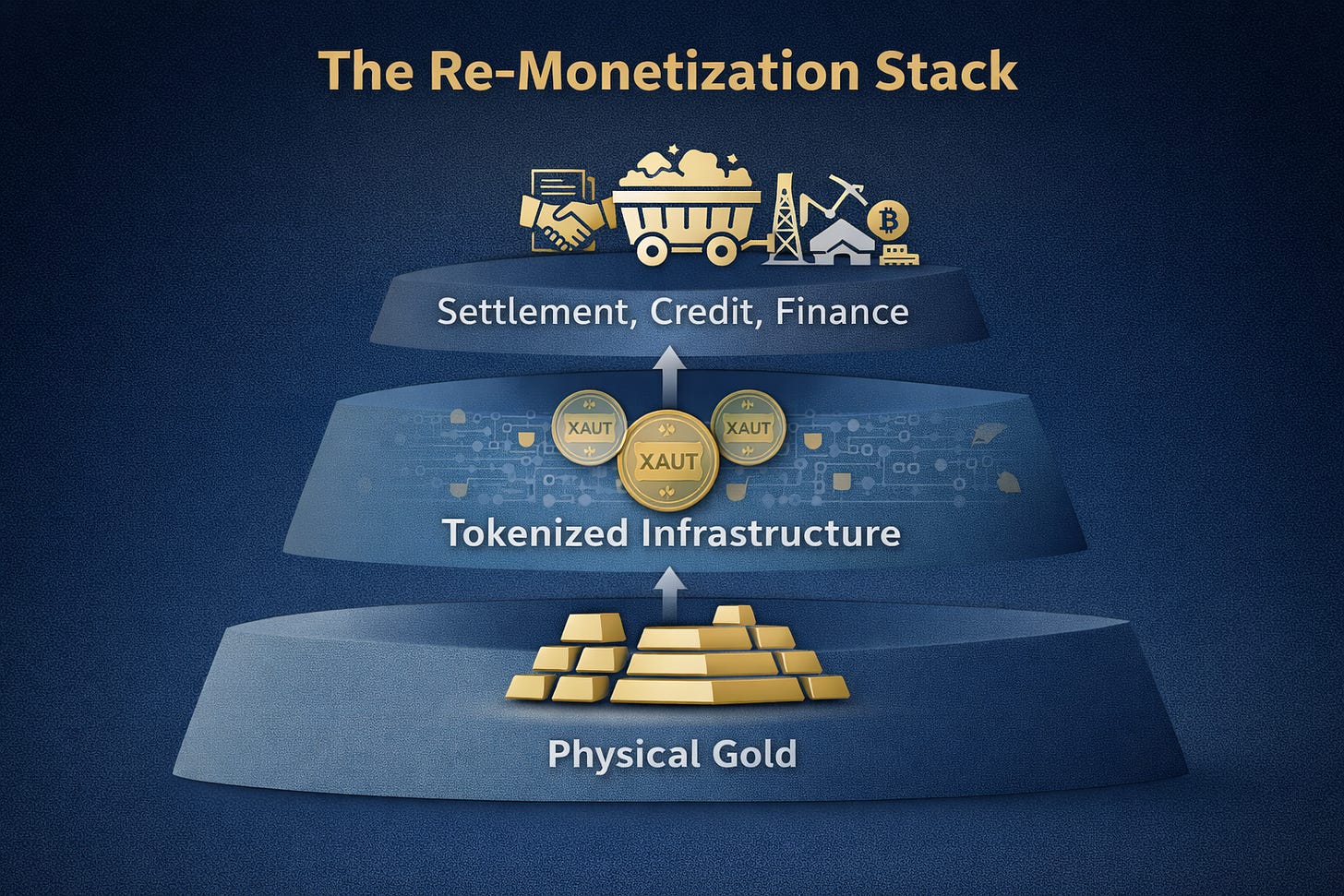

This shift is significant. It reflects a growing recognition among large investors that the post-QE monetary environment has altered both risks and opportunities. Gold, historically seen as a hedge or portfolio diversifier, is now also being used as reserve collateral and for settlement infrastructure. Tether’s gold-backed token, XAUT, is one of the most ambitious efforts to merge physical bullion with digital financial systems on an institutional level.

USDT: The Profit Engine Behind the Strategy

Tether’s ability to pursue long-term strategic initiatives depends on a notably conservative, profitable core business model. Revenue from USDT issuance is primarily invested in short-term U.S. Treasury bills, providing yield (estimated at ~4%) with minimal credit or operational risks.

This profitability gives Tether a rare level of flexibility. Unlike most financial intermediaries, it does not rely on leverage, fee collection, or short-term monetization. It can afford to develop infrastructure that emphasizes durability and balance-sheet health over growth appearances.

However, the era of free deposits might be ending for the US dollar-denominated stablecoin market. Several issuers are testing yield-bearing USD tokens that pass some of the underlying Treasury or money-market returns directly to holders. These products could, in theory, challenge existing stablecoins by reimagining them not just as transactional tools but as cash equivalents that generate income, while also reducing profitability for the owner.

However, in reality, distributing yields introduces complications that pure settlement tokens avoid: regulatory challenges, tax consequences, wallet-level accounting issues, and the risk of being classified as securities or investment products in key regions. These restrictions hinder the broad adoption that has driven USDT’s dominance. While yield-bearing dollar tokens might attract some institutional or treasury users, they are unlikely to replace a zero-yield, frictionless settlement asset on a global scale. The competitive pressure is real, but it is structural rather than existential.

XAUT: Bringing Physical Gold Fully On-Chain

XAUT is Tether’s second main strategic pillar. Each token equals one troy ounce of physical gold, stored in LBMA-standard 12.5-kilogram bars in Switzerland. The gold is fully allocated, owned outright, and linked to on-chain tokens at the bar level.

Core characteristics include:

1 XAUT = 1 oz of physical gold.

Custody exclusively in LBMA-certified bars.

Physical redemption is available on demand.

No storage fees charged to holders.

No transaction fees.

Fractional ownership is supported in a limited, practical manner

Unlike fiat-backed stablecoins, XAUT does not represent a claim on a balance sheet dominated by sovereign obligations. It is instead a direct digital representation of a tangible monetary asset.

XAUT quickly reached $1 billion in value, but growth has since slowed, and the market cap is now $2.32 billion, consisting of 1,329 bars or 16.2 tonnes of gold.

The slower growth reflects not a lack of demand but a recognition of physical market limits that don't apply to purely financial instruments. For example, even a small investment from USDT into gold-backed tokens would imply tens of billions of dollars in additional bullion demand, which the physical market simply cannot accommodate.

Rather than relying solely on token inflows, Tether has opted for a more cautious approach: collecting physical gold directly on its own balance sheet to secure future liquidity and redemption capacity.

Tether is now among the largest private holders of unhedged physical gold worldwide, with an estimated value of over $20 billion. Gold custody is centralized in a Swiss vault, the jurisdiction widely recognized as the global hub for gold refining and storage, with roughly 70% of the refining market.

All bullion is sourced exclusively from regulated, accredited refineries to maintain chain-of-custody integrity. BDO provides regular attestation, and Tether publishes a list of XAUT bars in inventory, which are linked to circulating tokens.

XAUT and the Gold ETF Comparison

Traditional gold ETFs collectively hold an estimated $250 billion in assets, but they remain structurally constrained:

Market-hours trading and limited to EOD execution.

Annual management fees.

Incremental ownership reduction.

Limited or unavailable physical redemption.

Dependence on banking and brokerage systems.

By contrast, XAUT offers:

24/7 tradability.

No management or storage fees.

Always-available physical redemption.

Direct ownership without reliance on bank intermediaries.

Mining Equities, Royalties, and Capital Allocation Discipline

Tether has shaken up the entire precious metals market by gaining equity exposure through ownership in value-priced royalty companies. Royalty businesses align with Tether’s demand for balance-sheet discipline and gold-denominated capital structures, making them complements to physical bullion rather than substitutes.

That produces a clear reserve hierarchy for Tether:

U.S. Treasuries

Gold

Bitcoin

Productive real assets

The USD base risk is offset by gold and Bitcoin that benefit from skepticism toward fiat durability and confidence in scarce, non-sovereign stores of value.

Conclusion

XAUT demonstrates a deliberate strategy: fully backed, physically redeemable, conservatively operated, and limited by real-world logistics rather than financialization games. It is a balance-sheet-driven shift toward monetary assets that are outside the liabilities of governments and banks.

For the mining industry, the impact has been and will likely continue to be significant. Gold is increasingly regarded as a reserve asset by large, non-sovereign entities with global reach. New methods for settlement, collateralization, and working-capital financing are emerging alongside this change, and they are built on physical ownership rather than synthetic exposure.

Whether gold-backed digital tools remain a niche or challenge traditional financial products directly, the trend is clear. Gold is regaining prominence in monetary discussions, and the infrastructure surrounding it is becoming more digital, global, and balance-sheet focused. For miners, investors, and policymakers, this is a development worth participating in as early as possible because of its capital formation implications.