The Changing Faces of the ASX Gold Sector

Should Aussie companies be thinking bigger?

The Australian gold sector is in a strong position but Evolution Mining (ASX: EVN) chairman Jake Klein warned that companies needed to rely on more than just the strong gold price to maintain their standing.

Speaking at the Melbourne Mining Club this week, Klein reflected on the evolution of the ASX gold sector.

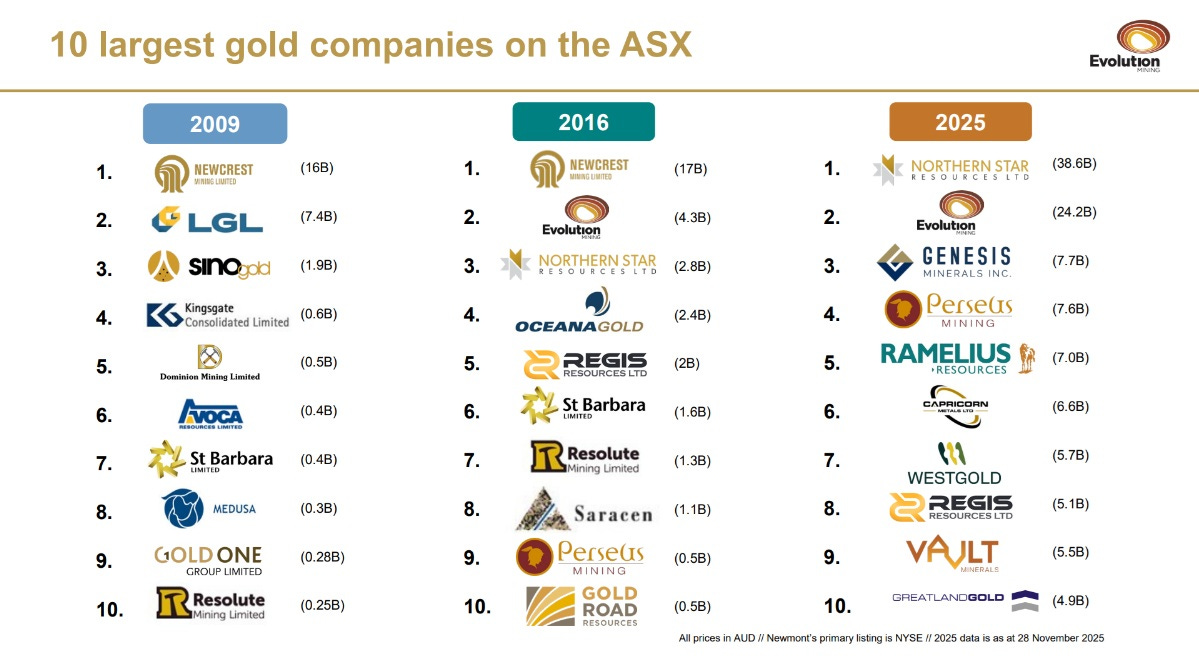

Of the companies in the top 10 in 2009, only Kingsgate Consolidated (ASX: KCN), St Barbara (ASX: SBM) and Resolute Mining (ASX/LSE: RSG) still exist, though have not maintained the pace of growth to remain on the list.

Of the 2016 list, Newcrest was acquired by Newmont Corporation (NYSE: NEM), Saracen Mineral Holdings was acquired by Northern Star Resources (ASX: NST) and Gold Road Resources was acquired by Gold Fields (JSE: GFI), while OceanaGold Corp (TSX: OGC) abandoned the ASX.

Evolution and its nearest peer Northern Star catapulted onto the list by acquiring assets from Newmont and Barrick Mining Corporation (NYSE: B).

Of the newcomers on the 2025 list, Genesis Minerals (ASX: GMD), Ramelius Resources (ASX: RMS), Capricorn Metals (ASX: CMM) and Westgold Resources (ASX: WGX) were around before 2016 but got much larger via production growth and acquisitions.

Vault Minerals (ASX: VAU) was the product of a merger between Silver Lake Resources and Red 5, while Greatland Resources (ASX/LSE: GGP) burst onto the scene in a big way this year via its acquisition of Newmont’s Telfer mine.

“I think that the companies that you see in the 2025 list are pretty good. The Australian sector is in good health,” Klein said.

“There’ve been some really good deals done and new companies emerged which is great to see – helped a little bit by a A$6000 gold price.

“I think the challenge is, can we maintain our discipline or are we going to suffer the fate that Warren Buffett always predicts in his famous quote that you will see who’s swimming naked when the tide goes out

“There will be a time when the gold price isn’t as good as it is today and that will require these companies in that 2025 list to have demonstrated that they’re not just there because of the gold price.”

Getting nostalgic

The ASX lost its largest listed gold producer in late 2023 when Newmont acquired Newcrest for around A$20 billion.

“I think I have some nostalgia that Newcrest is no longer an Australian company, and I think one of the challenges we face with the sector is, is Australia just an incubator for mining companies to grow to a certain point where they get taken over by an offshore major?

“Or was there an opportunity for Newcrest to have potentially combined with a Northern Star and an Evolution or, frankly, to have acquired the assets that Northern Star and Evolution acquired?

“So, are we not setting our bar high enough in terms of the potential for an Australian gold company to really be a true global leader, rather than just kind of waiting to be acquired by a major?”

Shrinking relevance

In 2009, Exxon was the world’s largest company with a market capitalisation of US$323 billion. At the time, BHP (ASX: BHP), the world’s largest resources company, was 1.5 times smaller than Exxon at US$214 billion.

In 2016, BHP was six times smaller than the world’s largest company at the time, Apple.

Today, Nvidia is the world’s largest company with a market cap of US$4.3 trillion, while BHP is valued at US$141 billion.

Interestingly, Newmont is closing the gap on BHP with a market cap approaching US$100 billion.

“I think it brings into question, how do BHP and other resource companies retain their relevance, given that a New York fund manager who’s benchmarking against the Dow Jones and S&P 100 indexes probably doesn’t need to own any resources to meet or exceed the benchmark,” Klein said.

“I suspect BHP’s road trips to New York or London are less busy than they used to be.

“But the opportunity is really in Australia, where we have a A$4 trillion superannuation industry, we have over A$50 billion in passive funds, and in the fund management industry and the super industry, we really have knowledgeable experts who are really interested in the resource space, so I think it’s an opportunity for Australia to become the global epicentre of the capital markets for resources.”

Zijin’s emergence

While BHP has shrunk, the big mover has been China’s Zijin Mining (SH: 601899).

In 2016, Zijin was worth US$10 billion, but today its capped at US$107 billion and is snapping at BHP’s heels.

“I think we need to just look up and realise that not only have the global markets and scale of the markets changed, but China has methodically implemented a strategy, which I think they set out to do 30 years ago, of growing their own companies,” Klein said.

Zijin recently spun out subsidiary Zijin Gold International (HK: 2259) in a US$3.3 billion initial public offering in Hong Kong, one of the largest this year.

The subsidiary has a market cap of nearly US$50 billion and owns eight producing gold mines outside of China with forecast production of 1.5-1.8 million ounces per year.

“The equity raise was 200 times oversubscribed. The price went up 70% on debut and these assets are in jurisdictions which probably we wouldn’t consider,” Klein said.

“The risk appetite is certainly higher, and they are on the march.”