What’s the Outlook for Gold in 2026?

The overwhelming consensus is that more records are in store next year

It’s been another year of record highs for gold prices, but the stars are aligning for more of the same in 2026.

Gold hit a new record high on Monday afternoon during Asian trade, pushing through US$4400 an ounce for the first time ever.

“Gold felt a ‘consensus long’ at the start of 2025 and remains so into 2026,” analysts from UBS said at the start of December.

“At times, gold has felt a very crowded momentum trade, but traditional measures do not show extreme crowding (Comex net long and ETF inflows), with gold’s ascent supported by broad based buying reflecting a structural shift in private and official sector demand.

“After a period of excessive enthusiasm in Sep/Oct, gold has consolidated and whilst we are cognisant that no bull market last forever, in our view the macro logic for gold remains robust and we do not see the set-up for a bear market in 2026.”

UBS expects the logic for sustained central bank buying to remain intact and noted the past five bear markets occurred during periods of increasing economic growth, reducing inflation/expectations, a stronger US dollar and reduced risk premia/uncertainty.

“We expect the opposite of these variables over the next 6-12 months and believe this, combined with ongoing de-dollarisation/debasement trade, will sustain asset allocations to gold.”

UBS expects gold to average US$4675 an ounce in 2025.

The 5000 club

A growing chorus of analysts see gold reaching US$5000/oz next year.

Australian firm Argonaut expects gold to rise steadily through 2026, averaging US$4400/oz in the March quarter, rising to an average of US$5000/oz by the December quarter.

“Spot gold prices have surged well ahead of our bullish outlook for the yellow metal,” analysts Hayden Bairstow and Patrick Streater said last week.

“Rising government debt balances and favourable monetary policy continues to drive gold prices higher.

“We now call for a peak of US$5200/oz in 2027, with gold expected to consolidate from a strong rise in 2026.”

J.P. Morgan has a similar view, based on its forecast of investor and central bank gold demand, which is projected to average around 585 tonnes a quarter.

It expects that every 100t of quarterly demand above 350t is worth around a 2% quarter-on-quarter rise in the price of gold.

“While this rally in gold has not, and will not, be linear, we believe the trends driving this rebasing higher in gold prices are not exhausted,” J.P. Morgan head of global commodities strategy Natasha Kaneva said last week.

“The long-term trend of official reserve and investor diversification into gold has further to run. We expect gold demand to push prices toward US$5000/oz by year-end 2026.”

J.P. Morgan is forecasting prices to average US$5055/oz by the December quarter of 2026, rising toward US$5400/oz by the end of 2027.

Even the bears are cautiously bullish

Citi global head of commodities Max Layton told CNBC this month that gold was at risk of losing momentum.

Citi has shifted to neutral to bearish on gold for the next 6-12 months.

“We’ve been bullish on gold for the past couple of years and caught the vast bulk of this rally … now we think it’s more risky,” Layton said.

“We don’t think it will go down much but we just don’t think it’s going to go up.

“The core is, is that President Trump has, in many ways, completed the reset of the trading relationship and we have seen the worst of the impact, we think – at least in terms of sentiment, on the US economy.”

Citi’s base case, with a probability of 30%, is for gold to fall to US$3600-3800/oz by the end of 2026.

However, its bull case, also with 30% probability, is for gold to reach US$5000/oz by the end of 2026 and US$6000/oz by the end of 2027.

“It’s entirely plausible that a very small wealth shift continues into gold and the market’s just too small, as we’ve seen this year, to handle small wealth shifts into gold,” Layton said.

“It’s very difficult to call up here at these outrageously high prices.”

ANZ Research believes the recent consolidation in price laid the foundations for another rally.

“That said, after an exceptional price rally this year, our base case suggests gold’s price gains will moderate in 2026, with an increase expected in the range of 12–15%,” commodity strategists Soni Kumari and Daniel Hynes said last week.

“We believe gains will be concentrated in the first half of the year with prices peaking near US$4800/oz; and we see a gradual decline in the second half as the Federal Reserve nears the end of its easing cycle, the impact of US tariffs becomes clearer and the economic outlook stabilises.”

ANZ’s bear case, in the event of an improving US growth outlook, a hawkish Fed stance and unexpected gains in the US dollar, is for gold to fall to US$3500/oz.

However, it acknowledged that a deteriorating global growth outlook, renewed trade tensions, compromised Fed independence and an equity sell-off could pose bullish risks to its forecasts, with prices potentially surpassing US$5000/oz.

Investors also bullish

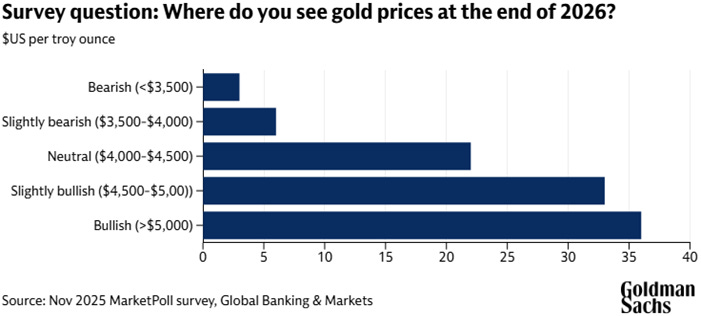

In mid-November, Goldman Sachs polled more than 900 clients on its Marquee platform.

“The largest proportion of respondents – 36% – think gold will exceed US$5000 per troy ounce by the end of next year,” it said.

“Central bank buying of gold and fiscal concerns were seen as the main drivers for the precious metal’s prices in 2026 by 38% and 27% of respondents, respectively.”

What about equities?

UBS noted that the GDX index had outperformed gold by around 80% this year.

“Consensus and spot EV/EBITDA and P/NPV multiples have re-rated vs cyclical lows in 4Q24/1Q25 and in our view, valuations/risk vs reward for gold equities are not as compelling as they were at the start of 2025; but it is too early to call the top of the cycle for gold miners (GDX),” it said.

Even if gold remains at around US$4000/oz, UBS believes the risk/reward profile remains attractive for equities.

“Spot valuations are generally undemanding vs five to 10-year averages, operational performance/reliability appears to be improving, the gold miners are delivering record free cashflow and most large cap miners are demonstrating discipline, lifting cash returns and remaining selective on capex/M&A,” UBS said.

“If the gold miners can continue to rebuild investor confidence/trust, we see potential for multiple expansion (vs spot) for selected stocks.”

UBS’ top North American picks are Barrick Mining Corporation (NYSE: B), Newmont Corporation (NYSE: NEM), Endeavour Mining (TSX: EDV), SSR Mining (TSX: SSRM) and Franco-Nevada Corporation (TSX: FNV), while its preferred Australian picks are Northern Star Resources (ASX: NST), Genesis Minerals (ASX: GMD), Perseus Mining (ASX: PRU) and Vault Minerals (ASX: VAU).

Similarly, Canaccord Genuity said the S&P/TSX Gold Index was up 139% as of Friday’s close, while the GDXJ was up 167%.

“Intermediate and junior producers led this year with median returns of 206% and 192% respectively, followed by the senior producers at 167% and 105% for the royalty and streamlining companies,” analyst Carey MacRury said.

“And notably, every company in our coverage universe of producers and royalty companies has outperformed the gold price year-to-date, delivering leverage to investors. And despite this performance, we continue to see valuations as reasonable.”

Its top North American picks are Endeavour, B2Gold Corp (TSX: BTO), Torex Gold Resources (TSX: TXG), Alamos Gold (TSX: AGI), Equinox Gold Corp (TSX: EQX), Aris Gold (TSX: ARIS), K92 Mining (TSX: KNT), Wheaton Precious Metals (TSX: WPM) and Elemental Royalty Corp (TSX: ELE).

Argonaut’s higher gold price forecast drove 7-30% price target increases across the ASX-listed companies it covers.

Its top picks are Northern Star, Catalyst Metals (ASX: CYL), Genesis, Westgold Resources (ASX: WGX), Bellevue Gold (ASX: BGL), Capricorn Metals (ASX: CMM) and Emerald Resources (ASX: EMR) among the producers, and Minerals 260 (ASX: MI6), Ballard Mining (ASX: BM1), Magnetic Resources (ASX: MAU), Wia Gold (ASX: WIA), Turaco Gold (ASX: TCG) and Santana Minerals (ASX: SMI) among the developers.